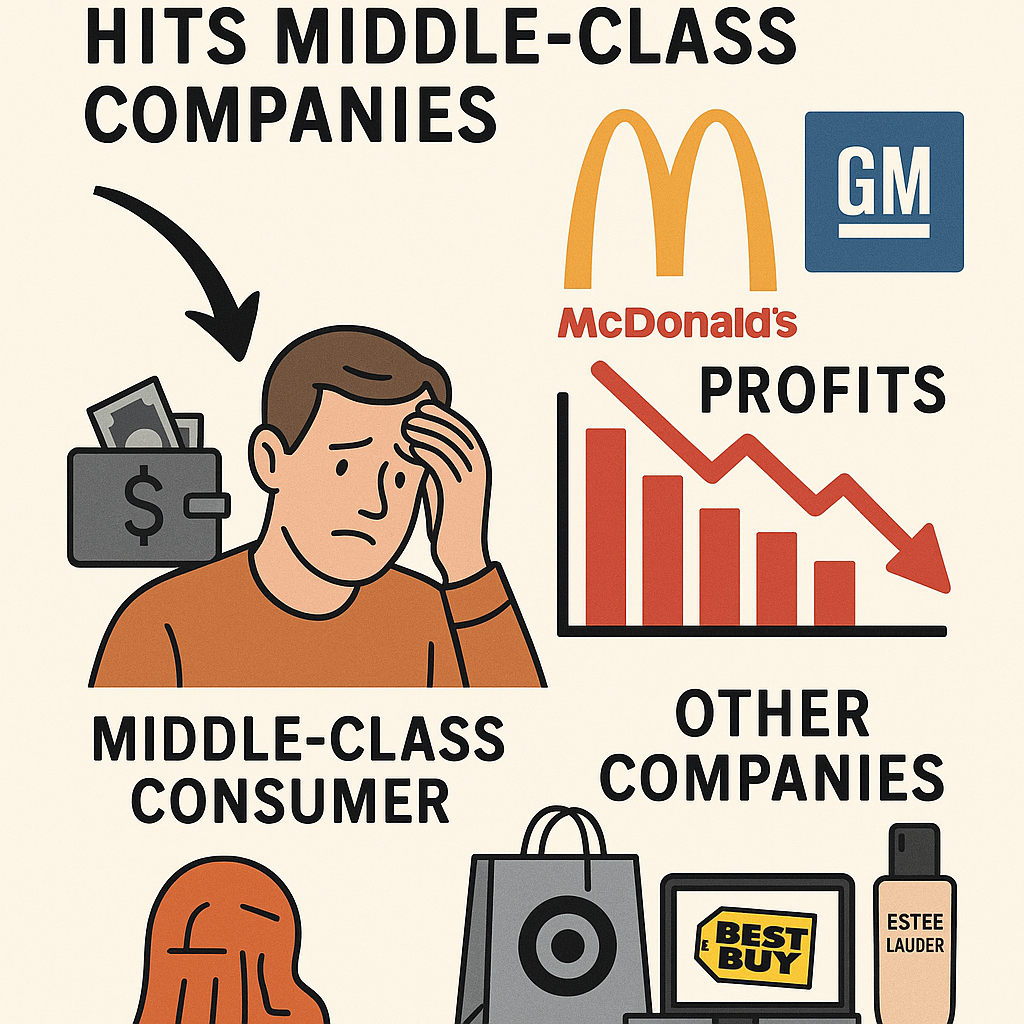

The American consumer confidence crisis of 2025 is sending shockwaves through the economy, with middle-class spending pulling back at historic rates. From fast food giants to automotive powerhouses, companies that built their empires on middle-class consumers are facing their most challenging market environment since the pandemic. The Conference Board's Consumer Confidence Index plummeted to 86.0 in April 2025—a five-month decline reaching levels not seen since May 2020. With the Expectations Index dropping to 54.4, we're entering recession-indicator territory, and major brands are feeling the pain.

The Fast Food Fallout: McDonald's Worst Quarter Since COVID

Golden Arches Losing Their Shine

McDonald's reported a stunning 3.6% decline in U.S. same-store sales for Q1 2025—its worst performance since the pandemic lockdowns. CEO Chris Kempczinski called it "the most challenging market environment" in years, as middle-class and lower-income customer visits plunged by double digits.

The iconic fast-food chain's attempts to win back customers with $5 meal deals have shown minimal impact. "Consumers are facing uncertainty and economic pressure," Kempczinski admitted, acknowledging that inflation, tariff chaos, and economic anxiety have severely eroded middle-class spending power.

The Domino Effect Across Fast Food

McDonald's isn't alone in its struggles:

- Domino's Pizza: Reporting significant sales softness as customers cut back on delivery orders

- Chipotle: Experiencing reduced foot traffic despite value-oriented marketing

- Starbucks: Seeing consumers skip their daily premium coffee runs

- Dollar General: Even discount retailers are noting reduced discretionary spending

Automotive Industry: GM's Tariff Troubles

General Motors slashed its 2025 revenue forecast to $10-12 billion, down from previous estimates, citing potential tariff-related costs of up to $5 billion. Despite CEO Mary Barra's diplomatic praise for Trump's automotive industry support, the reality is stark: import component tariffs are squeezing profit margins while consumer demand softens.

Retail Apocalypse 2.0: Major Chains Sound the Alarm

Target's Tariff Warning

Target reported disappointing holiday quarter results and issued a conservative 2025 outlook, citing "meaningful pressure" from tariffs on imports from Mexico, Canada, and China. The retailer's forecast doesn't even account for additional tariff impacts, suggesting further challenges ahead.

Macy's Economic Uncertainty

The department store giant expressed caution about 2025, with executives pointing to "economic uncertainty" as their primary concern. The Conference Board's survey showing reduced purchasing plans for big-ticket items like furniture directly impacts Macy's home goods segment.

Best Buy's Electronics Slowdown

Despite a slight uptick in appliance purchases (possibly to preempt tariff price hikes), Best Buy has grown increasingly cautious about 2025. Overall electronics demand has softened, particularly in high-margin categories like gaming and home theater systems.

The Luxury and Beauty Sector Feels the Pinch

Estée Lauder's Warning Signs

The beauty giant dramatically lowered its 2025 revenue forecast, citing North American sales declines driven by "consumer confidence and sentiment deterioration." Inventory buildup and retail destocking signal deeper troubles ahead.

Harley-Davidson Hits the Brakes

The iconic motorcycle manufacturer not only reported weak quarterly results but also withdrew its annual guidance entirely, citing "uncertain macroeconomic environment" and plummeting consumer confidence.

Abercrombie & Fitch's Millennial Problem

The apparel retailer adopted a cautious 2025 stance as middle-class millennials reduce clothing spending. McKinsey's ConsumerWise survey reported lower intentions to splurge on apparel in Q1 2025, with tariff-related cost increases threatening to further alienate price-sensitive customers.

The Perfect Storm: Why Consumer Confidence Collapsed

1. Tariff Terror

Increased mentions of tariffs in consumer surveys reflect fears of higher prices, particularly for imported goods. This significantly impacts retailers like Target and Best Buy, which rely on global supply chains.

2. Inflation Expectations Soar

Consumers' 12-month inflation expectations jumped to 7% in April 2025—the highest since November 2022. This erosion of purchasing power directly impacts middle-class spending decisions.

3. Recession Fears Mount

The Expectations Index below 80 signals heightened recession concerns, causing middle-class consumers to cut back on non-essentials more aggressively than high-income consumers.

4. Trust Deficit

According to the Edelman Trust Barometer, 71% of global consumers trust companies less than they did last year. American consumers show particular skepticism about corporate practices, from data privacy to AI implementation.

The Numbers Tell the Story

| Company | Industry | Response | Strategy |

| McDonald's | Fast Food | -3.6% same-store sales | $5 meal deals, value focus |

| GM | Automotive | $5B tariff cost exposure | Government collaboration |

| Target | Retail | Profit pressure warning | Cost management, value products |

| Estée Lauder | Beauty | Major revenue forecast cut | Inventory adjustment |

| Harley-Davidson | Motorcycles | Withdrew annual guidance | Strategic reassessment |

What This Means for the Economy

The consumer confidence crisis disproportionately affects mid-tier companies because middle-class consumers are more likely to cut discretionary spending compared to high-income consumers. McKinsey research shows middle- and low-income consumers reported significantly less optimism than high-income consumers in Q1 2025.

The Spending Shift

- 43% of Americans changed their spending patterns based on personal beliefs

- 36% actively "opted out" of certain economic activities

- Middle-class consumers are increasingly choosing home cooking over restaurant dining

- Non-essential retail purchases have declined across categories

The Road Ahead: Recovery or Recession?

The decline in consumer confidence isn't just a temporary blip—it's a fundamental shift in how middle-class Americans approach spending. For companies to recover, several factors need to align:

- Tariff Policy Clarity: Businesses need predictable trade policies to plan effectively

- Inflation Control: The Fed must balance growth support with inflation management

- Trust Rebuilding: Companies must address consumer skepticism through transparency

- Value Innovation: Brands need to deliver genuine value, not just discounts

Conclusion

The 2025 consumer confidence crisis represents a pivotal moment for American businesses. Companies that thrived on middle-class spending are now scrambling to adapt to a new reality where economic uncertainty, inflation fears, and policy volatility have fundamentally altered consumer behavior.

For investors, the message is clear: watch consumer confidence indicators closely. For businesses, the imperative is adaptation—those who can rebuild trust, deliver value, and navigate policy uncertainty will emerge stronger. For policymakers, the challenge is balancing economic nationalism with consumer welfare.

The American middle class isn't just tightening belts—they're rewriting the rules of consumer engagement. Companies that fail to adapt may find themselves on the wrong side of history.